4 Easy Facts About Lamina Loans Explained

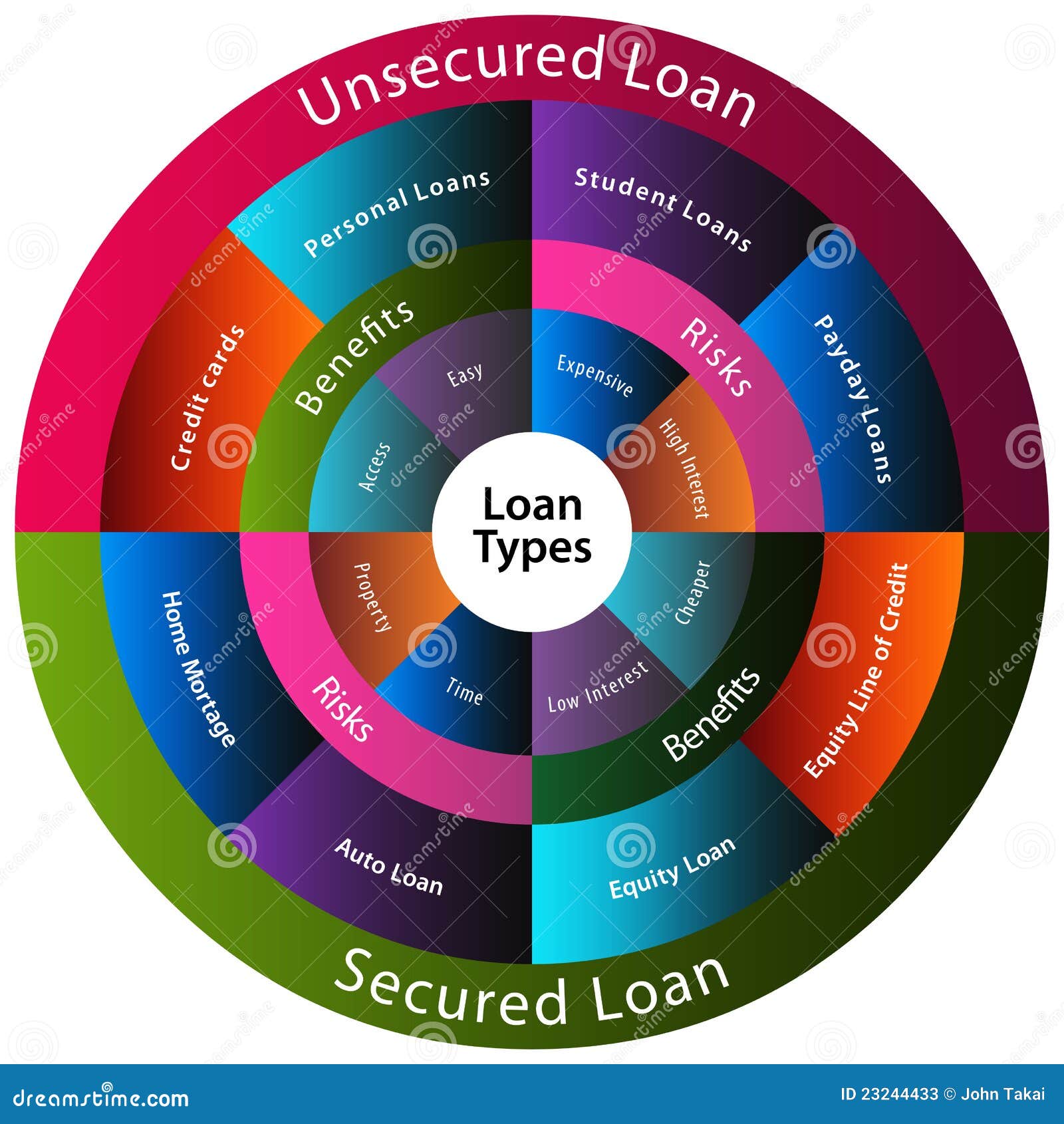

The rates of interest could be close to 35% than the 6% rate those with wonderful credit scores obtain, however 35% is still a whole lot far better than the 391% from a cash advance loan provider. Payday loan providers prey on people in determined financial circumstances, suggesting low-income, minority families, participants of the army and any individual else that has limited credit scores alternatives.

There likewise is long-term damages to your credit report. Though some cash advance loan providers don't report directly to the 3 significant credit history reporting bureaus in the United States, many report to the minor companies. If the financial obligation mosts likely to a collection agency, that company practically always reports non-payment to the major credit score bureaus, which damages your credit report.

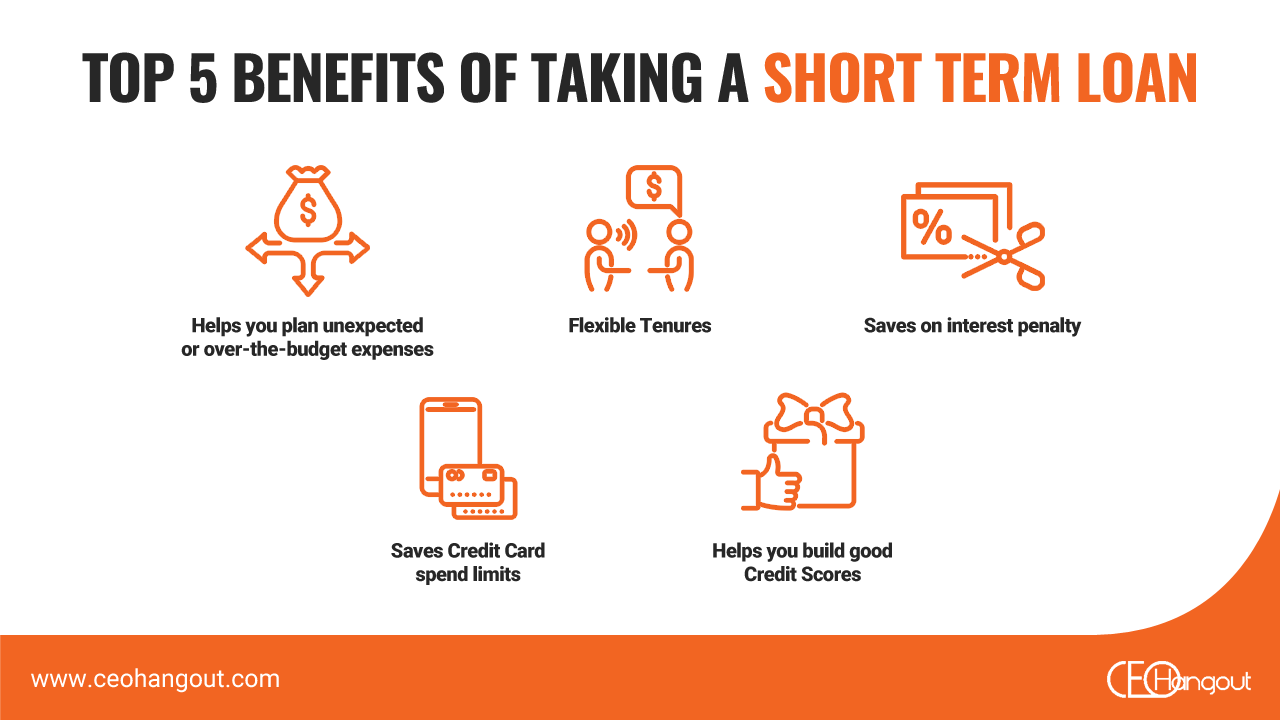

Filling Something is filling. Thanks for subscribing! Gain access to your preferred subjects in a personalized feed while you're on the go. download the app When you need cash, there are several sensible ways to get it. You may have the ability to get a tiny lending from family or friends, and you can always make an application for a bank card.

Our Lamina Loans Statements

While personal finances may have obtained a poor rap in some circles, they can provide a foreseeable method to obtain money. An individual funding is cash you borrow from a bank, credit history union, or on-line lending institution that you pay off with interest over a set time period. Individual car loans are installment finances, like home mortgages as well as vehicle loan.

Unlike many other types of installation finances, however, unsecured individual lendings are conventional, like bank card debt. That indicates you don't require to offer any security. Typical personal funding interest rates have a tendency to be greater than the rates on secured finances however less than charge card rates of interest. Personal fundings allow you borrow a predetermined amount of cash with a set rates of interest as well as a fixed payment period.

Individual finances are likewise popular to consolidate financial obligation, and it's easy to see why. Visualize you're a customer with high-interest bank card debt that's sucking your budget completely dry monthly. A personal funding might aid you consolidate that financial obligation at a reduced rates of interest while safeguarding a foreseeable month-to-month repayment and also an established reward day that doesn't transform.

Some Known Details About Lamina Loans

You'll obviously want to select a loan with the most affordable rates of interest you can receive, but fees matter, also. You can prequalify for a personal lending with many loan providers prior to you send an application. This allows you to see the prices and also terms they're likely to use you prior to they do a hard credit history query, which is most likely to cause a mild dip in your debt rating momentarily.

However, the extremely competitive nature of the personal financings service implies that several individual finances come without charges for consumers who qualify. It's vital to take into consideration costs associated with a personal lending, to ensure it doesn't make the complete price of your debt greater ultimately.

As you contrast individual lender, you'll wish to try to find: A lending institution that supplies affordable rates of interest, No charges or marginal charges, A regular monthly payment and also finance term you can manage, Also take into consideration exactly how rapidly you require money and take an appearance at quick personal finance options if you require it right away.

Lamina Loans for Dummies

At the very the very least, you'll pay a much greater rate of interest price to obtain a finance with bad credit history. Most lending institutions provide a minimum credit rating to get a financing on their web site, with numerous drawing the line at 670 or 680. With a credit rating below what is considered "extremely great credit," or 740, however, you will likely pay a higher rates of interest.

That means you receive a lump-sum settlement of cash, which you after that pay back, with rate look here of interest, over a fixed time period - Lamina Loans. With a fixed-interest individual finance, your monthly settlement will constantly coincide. As with any kind of financial debt, securing an individual lending comes with the risk that you will not be able to repay it on schedule, which can result in added costs and hurt your credit history.

An individual car loan is an installment loan that commonly includes a fixed interest price. That implies you get a lum-sum payment of money and also you make month-to-month settlements of equal quantities over a set time period up until you've settled the loan as well as the passion. Freelance Writer.

The factors to get a car loan are as distinct and varied as the people that request them. Every individual's financial scenario is different. As well as there are countless aspects Read Full Article that influence the decision to borrow funds. At Tower Financing, we understand that. This means that when unexpected costs arise, most of US households just do not have the monetary methods to take in the expense.

8 Simple Techniques For Lamina Loans

In addition, online lendings offer a degree of comfort that many conventional banks and organizations are unable to offer. For instance, an individual seeking to obtain a financing can apply to Tower Lending from anywhere they have a net connection, removing the need to travel to an office, take time off job throughout company hrs, or wait till the doors of a physical area are open.

By making our application procedure as easily accessible and as basic as feasible, we help our customers prevent the tension and potential chaos that is additional info so frequently experienced throughout times of economic hardship.

Basically, yes., so there's no need for security or security to be put up. You are cost-free to make use of the funds at your discretion, and will need to pay back the lending in dealt with monthly instalments.